In the rapidly evolving global vaping industry, Longfill e-liquids are emerging as a preferred choice for users worldwide, offering a compelling blend of customization, cost efficiency, and regulatory compliance. Popular in Europe for years, Longfills are now gaining traction globally as tax pressures on vaping products intensify. This flexible format empowers users to craft tailored e-liquids while addressing fiscal challenges. As a leading e-liquid manufacturer, YTOO delivers customized Longfill solutions, meeting market demands with precision and innovation.

What Are Longfill E-Liquids?

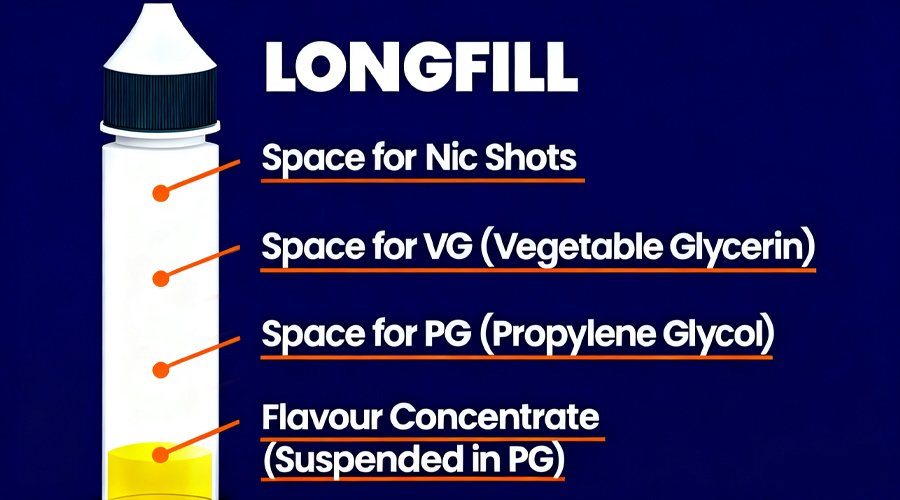

A Longfill is a partially filled bottle of flavor concentrate, designed to provide diverse taste profiles such as fruit, menthol, tobacco, or other options. Users add VG (vegetable glycerin), PG (propylene glycol), and nicotine shots to create ready-to-vape e-liquid, allowing full control over nicotine strength and VG/PG ratios. Typically sold in 60ml or 120ml bottles with space for VG/PG and nicotine shots, filled to approximately 80% capacity, Longfills comply with the EU Tobacco Products Directive (TPD) Article 20, which restricts nicotine-containing liquids to 10ml while permitting larger non-nicotine concentrates.

This user-driven approach not only enhances personalization but also delivers cost advantages in markets where taxes are based on liquid volume, creating a win-win for consumers and brands.

Navigating Taxation: Lessons from Germany and the UK

Germany’s Experience

Under Germany’s Tobacco Tax Act (Tabaksteuergesetz), e-liquids, including Longfills, are subject to excise duty at €0.26 per ml in 2025, increasing to €0.32 per ml in 2026, plus 19% VAT, positioning Germany as one of Europe’s higher-tax vaping markets. The key advantage of Longfills lies in their tax structure: only the concentrate is taxed, while user-added VG, PG, and nicotine shots are generally exempt under current regulations. This significantly reduces the overall tax burden compared to pre-mixed e-liquids, which are taxed on their full volume. German vaping market data shows consistent growth in Longfill adoption since 2020, favored by cost-conscious vapers.

The UK’s Outlook

Per the UK’s Finance Act 2024, a Vaping Products Duty (VPD) will take effect on October 1, 2026, imposing a flat £2.20 excise per 10ml of e-liquid—nicotine and non-nicotine alike—plus VAT. Aimed at reducing youth vaping and supporting public health, the policy mandates duty stamps on packaging, with a transition period until April 2027. HMRC estimates a potential 20-30% price increase for pre-mixed e-liquids.

Longfills offer a strategic solution: by purchasing smaller volumes of taxed concentrate and supplementing with separately sourced (potentially untaxed or lower-taxed) base liquids and nicotine shots, users can minimize tax exposure. Although nicotine shots may be taxed due to their nicotine content, the overall taxed volume remains lower. The Independent British Vape Trade Association (IBVTA) suggests that VPD may drive demand for DIY options like Longfills, with significant sales growth expected post-2026, mirroring European tax-driven trends.

YTOO: Pioneering Longfill Customization

As a GMP-certified, TPD-compliant e-liquid manufacturer, YTOO boasts a 500-ton monthly production capacity and specializes in OEM and white-label services, delivering tailored Longfill formulations for global markets. From vibrant fruit blends for European preferences to robust tobacco profiles for traditional users, YTOO customizes flavor intensity, VG/PG ratios, bottle sizes, and labeling to meet specific requirements.

YTOO has collaborated with multiple European brands to develop Longfill product lines that balance TPD compliance with tax efficiency. “We are committed to crafting region-specific formulations, ensuring brands and consumers access high-quality, cost-effective products,” says a YTOO representative. Amid evolving tax policies, YTOO’s adaptable solutions empower retailers and brands to meet consumer demands for personalization and affordability.

The Global Potential of Longfills

Driven by Europe’s high-tax frameworks and the UK’s forthcoming VPD, Longfills represent a strategic evolution in the vaping industry. They enable flavor customization, optimize costs through targeted volume taxation, and enhance efficiency by reducing packaging waste through single larger bottles compared to multiple smaller pre-mixed products.

While most prominent in Europe, data from markets like Australia and parts of Asia indicates growing appeal in regions with similar volume-based taxes. For vapers seeking personalization and cost efficiency, Longfills provide a practical solution.

Discover YTOO’s customized e-liquid solutions, including Longfills, at www.ytoojuice.com.